Tax adjustments have not been made in the interim budget by Finance Minister Nirmala Sitharaman. The tax slab has not changed from what it was previously. To the people’s great relief, the Finance Minister has raised the amount to twenty-five thousand rupees (Rs. 25,000) for the period up to the 2009–10 financial year and ten thousand rupees (Rs. 10,000) for the period from the 2010–11 financial year to the financial year 2014–2015. The outstanding demand for direct tax has been removed. It is expected that this will help about one crore taxpayers.

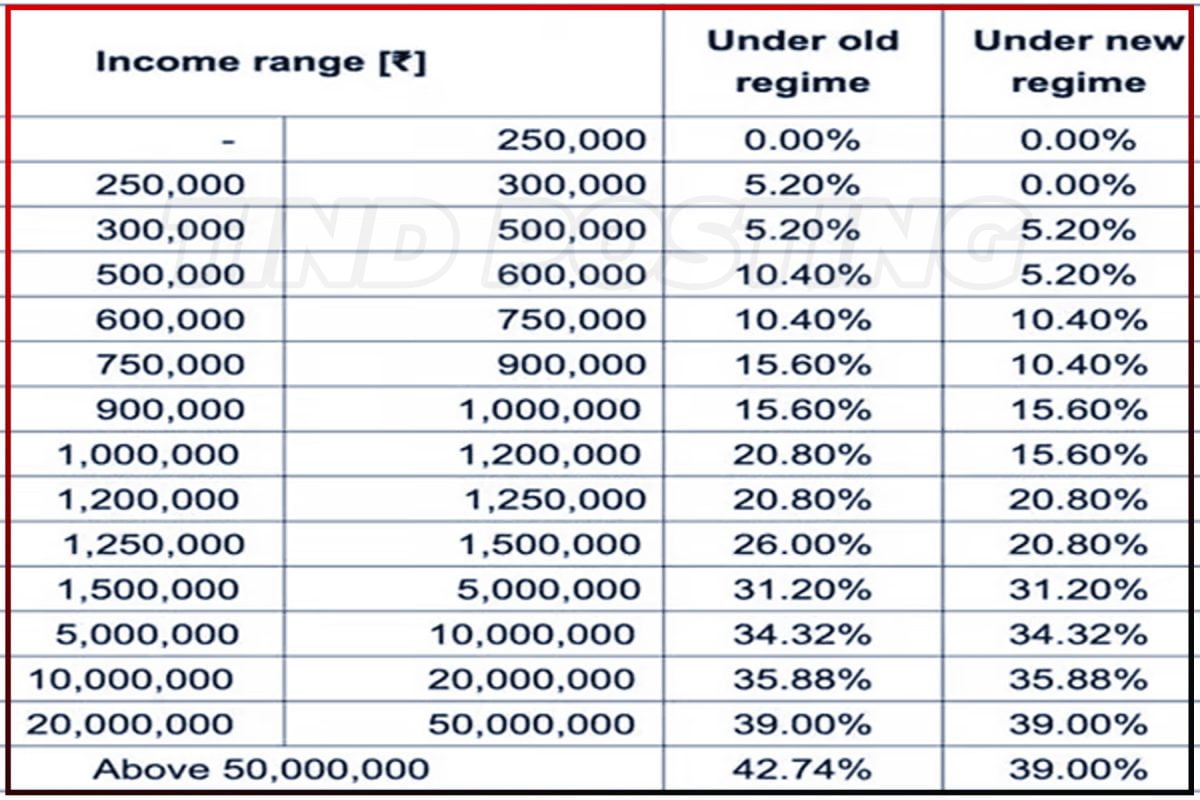

In the interim budget, the government did not provide the average citizen with any income tax relief. Your income up to Rs 2.5 lakh will continue to be tax-free if you choose the previous tax system. On the other hand, you can deduct up to Rs 5 lakh in income tax under Section 87A of the Income Tax Act.

You won’t be required to pay tax on income up to Rs 3 lakh under the new tax regime. In this case, as well, salaried individuals are also eligible for tax exemption on income up to Rs 7.5 lakh and other individuals are eligible for tax exemption on income up to Rs 7 lakh under Section 87A of the Income Tax Act.

In order to encourage economic growth, Nirmala Sitharaman has suggested raising capital expenditure by 11% to Rs 11.11 lakh crore when presenting the Vote on Account, or interim budget, for the financial year 2024–2025. The goal for the financial deficit in this financial year has also been adjusted, now standing at 5.8% of GDP. A budget for expenses totaling Rs 47.66 lakh crore has been submitted.

Simultaneously, the updated projection of the fiscal deficit for this financial year has been lowered from 5.9 percent to 5.8 percent. For the upcoming financial year, the projected deficit is 5.1%. He asserted that improved governance and economic management had enabled every obstacle to be surmounted before 2014.